The Adler Team Mortgage Rate Forecast

Mortgage Interest Rate Prediction:

"Will rates go down in January 2023?"

Mortgage rate forecast for the week of December 26-30th: 😃

Interest rates decreased for the sixth straight week, falling to the lowest point of the fourth quarter just in time for holiday home shoppers.

The average 30-year fixed rate mortgage inched down from 6.31% on Dec. 15 to 6.27% on Dec. 22, according to Freddie Mac.

With inflation showing signs of cooling and the Fed taking a softer policy stance, there is less upward pressure on mortgage rates.

Will mortgage rates go down in January? 👊🏠

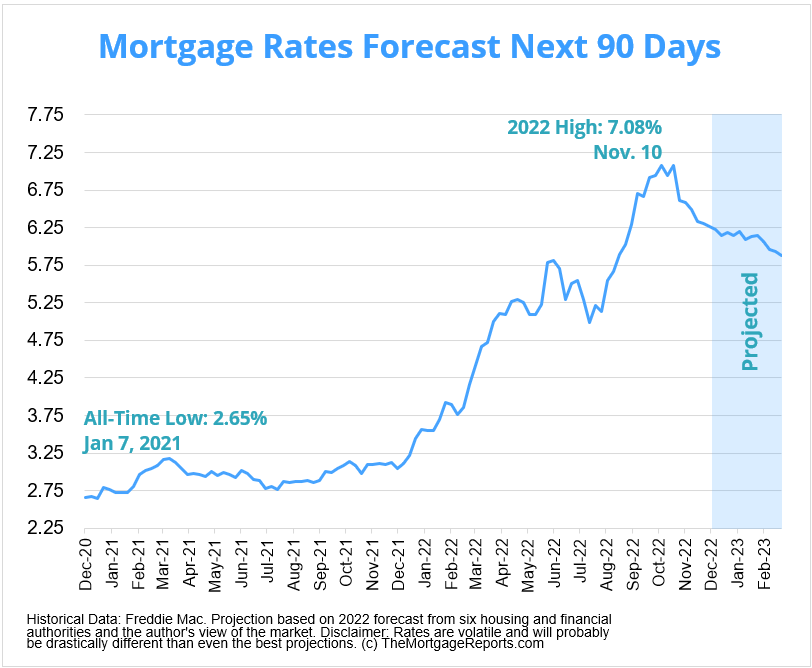

Mortgage rates fluctuated greatly in 2022. The average 30-year fixed rate went as low as 3.22% on Jan. 6 and reached a high-water mark of 7.08% on Nov. 10, according to Freddie Mac.

The year’s big rate movements can be attributed largely to the Federal Reserve’s aggressive actions to help combat decades-high inflation. However, with inflation starting to cool, the Fed eased its foot off the gas in December and is expected to make smaller rate hikes in 2023.

With the economy likely heading into a recession, it’s possible we’ve already seen the peak of this rate cycle. Of course, interest rates are notoriously volatile and could tick back up on any given week.

Here are 3 expert mortgage rate predictions for January:

1. Rates will moderate

“We’ve seen inflation numbers cooling off the past couple of months and mortgage rates responded by following that. As inflation continues to come down even more, that will help take some pressure off of mortgage rates. We’re not going to see as many rapid rate movements. We’ll likely see rates stabilizing and coast around the range they’re in now for the next couple of months.”

By: Nicole Bachaud, senior economist at Zillow

2. Rates will drop

“Mortgage rates will likely start the year near 6.2%. Two of the main factors affecting today’s mortgage market have recently become more favorable. Inflation continues to ease while the Federal Reserve has switched to smaller interest rate hikes. 2022’s higher federal funds rates have started to tame inflation. Thus, mortgage rates will likely stabilize below 6% in 2023.

While that’s a lot more money buyers must pay out every month, interest rates between 3% and 6% are still lower than 8%, which is the historical average rate for a 30-year fixed mortgage.”

By: Nadia Evangelou, senior economist & director of forecasting a the National Association of Realtors

3. Rates will drop

“I think mortgage rates could continue to fall, but remain above 6% in January, as inflation showed signs of pulling back and a few economic indicators point to some early signs of economic weakening. Mortgage rate spreads, while still elevated, have been shrinking. This is also driving the decline in rates. Investors may be anticipating the Fed pulling back monetary tightening sooner than the Fed is currently communicating. ”

By: Selma Hepp, deputy chief economist at Corelogic

Mortgage Interest Rates Forecast Next 90 Days:

As inflation ran rampant in 2022, the Federal Reserve took action to bring it down and that led to big interest rate growth. The average 30-year fixed-rate mortgage more than doubled within the course of the year.

However, with inflation cooling, the Fed starting to slow its rate hikes, and the likelihood of a recession, many experts currently believe mortgage interest rates will descend or move within a tighter range compared to the spikes we saw earlier in 2022.

Of course, rates could rise on any given week or if another global event causes widespread uncertainty in the economy.